Will Ramos· Author

Updated: January 2024

The merchants who succeed in ecommerce have always understood, met, and exceeded consumer expectations. One crucial component of the buyer experience is how consumers choose to pay. Like the server at an upscale restaurant, the checkout cart needs to predict the customer’s needs and be ready to solve any challenge.

At Bizrate Insights, we specialize in helping ecommerce merchants understand consumer behavior and sentiment. We surveyed 1,175 verified ecommerce shoppers, and this is what we learned about consumer payment preferences.

Analyzing Consumer Payment Preferences

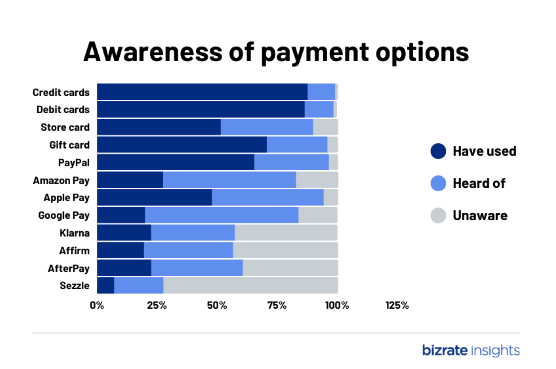

Traditional methods like credit cards (used by 87.6% of respondents) and debit cards (used by 86.37%) continue to reign supreme.

For merchants, this payment preference means a continued focus on optimizing the credit and debit card payment journey, ensuring a seamless process. Offering the option of storing credit card information for future purchases is one way to reduce friction when entering a payment method.

Mobile Wallet Popularity on the Rise

Despite the popularity of debit and credit cards, offering alternative payment options is important. In fact, seeing multiple payment options is a common consumer expectation. One study found that 11% of people abandoned their cart because there weren’t enough available payment methods.

PayPal in particular shows deep market penetration (65.40% use it). Given that the number one factor for choosing any form of payment is convenience, this is attributable to PayPal’s low-click path and low effort required of the user.

Mobile wallet platforms such as Apple Pay, Amazon Pay, Google Pay, and Shop Pay show a mixed response as a consumer payment preference. Many know of them, but less than half use them.

However, their increasing popularity hints at the growing trust in digital payment methods. With mobile shopping becoming the norm, merchants would do well to consider these platforms integral to their payment strategy, ensuring compatibility and ease of use. Catering to website payment preferences like mobile wallets could improve the user experience, potentially increasing conversion rates.

Although lesser-known, Klarna, Affirm, and AfterPay have carved out their niche. Their presence underscores the growing demand for ‘buy now, pay later’ options. Merchants might consider integrating these, especially targeting younger demographics who appreciate flexible payment plans.

Factors Influencing Payment Choices

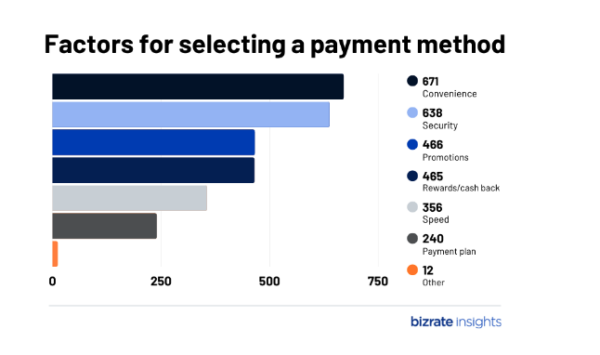

Convenience (57% of respondents) and security (54% of respondents) lead the pack when it comes to consumer payment preferences, which makes a clear statement: Consumers want their transactions to be effortless but secure. Merchants must prioritize security infrastructure while ensuring a smooth user experience.

Close contenders — rewards or cash back and promotions or discounts—indicate that consumers appreciate added value. Businesses could bolster loyalty programs and offer timely promotions, enticing users to prefer one payment method over another.

Does Age Affect Consumer Payment Preferences?

Age is a big factor in website payment preferences. This has a lot to do with what form of payment each age bracket is comfortable with. For example, Baby Boomers use cash more than younger generations — probably because it’s their most familiar and trusted payment method. However, they are also big users of credit cards.

Gen X and Millennials enjoy the convenience of using credit and debit cards for their purchases. Younger Millennials, among the age brackets most comfortable with technology, are also the biggest users of mobile payment apps.

Meanwhile, Gen Z payment preferences strongly favor debit cards, though they also show significant credit card use.

Overall, cash use has declined in recent years for all generations, making alternative payment methods all the more important.

When Consumers Opt Against Credit Cards

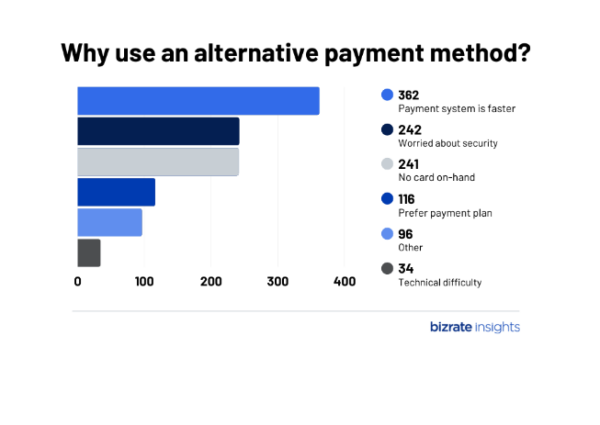

People choose alternative payment methods over credit cards primarily because of faster payment systems (30.8% of respondents), which indicates consumers’ preference for a frictionless experience. Merchants should invest in user-friendly platforms that make checking out quick and easy.

Additionally, security concerns (20.6% of respondents) underline the importance of trust in online transactions. Merchants should highlight the security measures they employ and consider third-party security certifications.

Flexible Payments: A Double-Edged Sword?

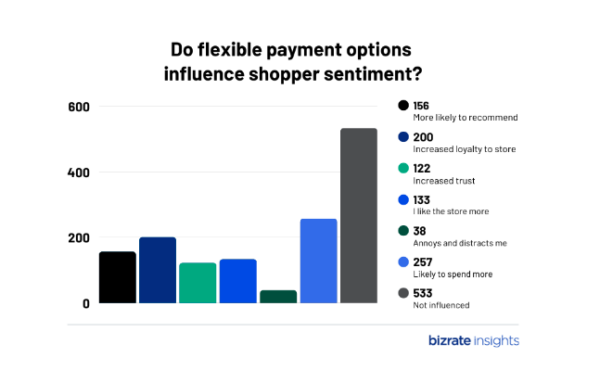

An impressive number of respondents (21.87%) admit they’d spend more money if given flexible options. This can’t be ignored. Businesses could see increased average order values by introducing or improving flexible payment options.

That said, a sizable group (45.36%) remains unaffected by these options. This underscores the importance of balance. Merchants should always seek ways to provide flexibility without overwhelming or distracting those who prefer straightforward payment methods.

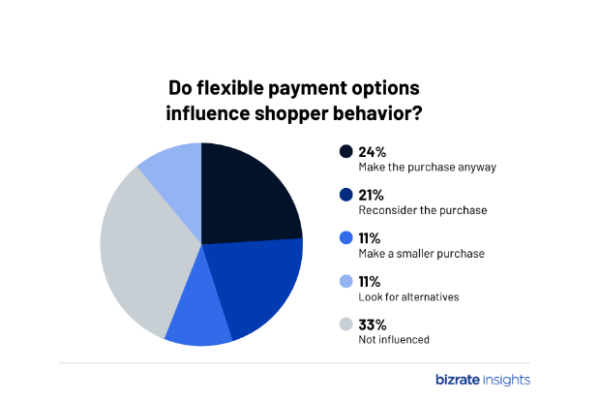

When Flexibility Isn’t on the Table

It is reassuring that 24.48% of shoppers would proceed with their purchase even without flexible options. It emphasizes the importance of product value and brand trust. However, the fact that 1 in 5 would reconsider their purchase without flexible payment options available underlines the risk merchants run. Diversifying payment options could mean the difference between a sale and an abandoned cart.

FAQ About Flexible Payment Options

The value of offering flexible payment options is becoming ever clearer. Many businesses have questions about this consumer payment preference — hopefully, we’ll address yours below.

What Are Flexible Payment Options, and How Do They Benefit Consumers?

Flexible payment options allow customers to pay for a product or service over time. A credit card is a traditional example — a customer can purchase something using the card and then pay for the purchase over the next few months. However, flexible payment options have evolved beyond credit cards to ‘buy now, pay later’ options and installment plans.

Flexible payment options benefit consumers by letting them purchase a product or service when they want or need it. This gives people of different financial backgrounds access to more products and services. Furthermore, evolving consumer payment preferences mean increasing demand for flexibility and alternative payment options.

How Can Businesses Implement Flexible Payment Options?

The easiest way to implement flexible payment options is to work with a trusted, flexible payment provider like Afterpay, Klarna, or Affirm. As the popularity of flexible payments rises, more and more providers become available, each offering its pros and cons for both customers and businesses.

Ultimately, businesses need to research which payment options and providers would be best for their customers.

Are There Security Concerns Associated with Flexible Payment Options?

Yes, there are security concerns associated with flexible payment options, but no more than with any other payment option. A data breach can happen to any payment provider — that’s why you need to pay attention to what prospective flexible payment providers do to ensure the security of customer information.

Do Flexible Payment Options Impact Conversion Rates?

Having flexible payment options positively impacts conversion rates. Customers who might otherwise walk away from your business due to prices are more likely to buy with flexible payments. Customers may also make larger purchases — increasing your profits.

How Can Businesses Promote Their Flexible Payment Options to Customers?

A business can promote its flexible payment options to customers like it promotes a new service or product. You can announce the arrival of the payment option on all your marketing channels — explaining all the benefits to your customers. You can also highlight these payment options on product pages and at checkout.

Can Businesses Customize Their Flexible Payment Options Based on Their Target Audience?

How much you can customize your flexible payment options depends on the provider, who sets out the payment terms. That’s why it’s important to find the right provider for your needs — or choose one that allows for more customization. You can also work with two or more flexible payment providers to offer customers a wider array of options.

Are There Any Additional Fees Associated with Certain Flexible Payment Options?

Yes, there are usually additional fees associated with flexible payment options. You’ll most likely have to pay a transaction fee for each purchase when using a third-party payment provider. Each provider will have a different processing fee, so this is one of the factors you’ll have to compare across providers when making your choice.

How Can Businesses Stay Updated on Emerging Trends in Flexible Payment Options?

Businesses can stay updated on emerging trends in flexible payment options by reading the latest articles and research by experts in the payment system industry. There’s no shortage of online resources discussing the future of flexible payments.

But if you want to stay ahead of the curve, you should gather and evaluate consumer feedback on an ongoing basis with the help of a partner like Bizrate Insights.

The Critical Component: Understanding Your Customers

The ecommerce realm demands adaptability. As our numbers suggest, while traditional consumer payment preferences are essential, there’s a growing appetite for varied, flexible, and secure payment options. Merchants must constantly evaluate and adapt their payment strategies to cater to a broad spectrum of preferences while upholding security and convenience.

Rather than guessing what your specific consumers need, why not gather consumer feedback on an ongoing, automatic basis? Better yet, get an intuitive dashboard showing consumer opinions, sentiment, effect, net promoter score, and much more.

Bizrate Insights offers Voice-of-Consumer solutions that allow you to ask custom questions, run industry benchmarking, and more. And the happiest news of all: Our solutions come at no cost to the merchant.

Stop guessing! Contact us today to learn why we’re considered the best consumer feedback platform.